New Delhi: Amendments to the I-T laws do not seek to tax inherited gold and jewellery as also those items that are purchased through disclosed or agriculture income, the government said yesterday.

The Lok Sabha earlier this week passed the Taxation Laws (Second Amendment) Bill, which proposes a steep up to 85 percent tax and penalty on undisclosed wealth that is discovered by tax authorities during search and seizure.

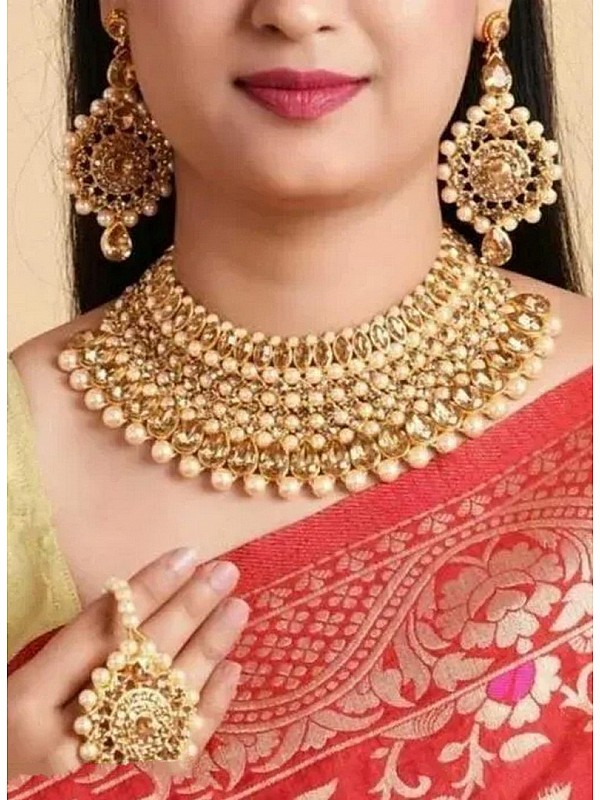

Dispelling rumours that jewellery would be covered under the amended law, the Central Board of Direct Taxes (CBDT) said the government has not introduced any new provision regarding chargeability of tax on jewellery.

“The jewellery/gold purchased out of disclosed income or out of exempted income like agricultural income or out of reasonable household savings or legally inherited which has been acquired out of explained sources is neither chargeable to tax under the existing provisions nor under the proposed amended provisions,” the CBDT said.

During search operations, conducted by I-T Department, there would be no seizure of gold jewellery and ornaments to the extent of 500 grams per married women, 250 gm per unmarried women as also 100 gm per male member of the family, it said. “Further, legitimate holding of jewellery up to any extent is fully protected,” it added.

The Bill, which is currently under consideration of the Rajya Sabha, will amend Section 115BBE of the Income Tax Act to provide for a steep 60 percent tax and a 25 percent surcharge on it (total 75 per cent) for black money holders.

Another section inserted provides for an additional 10 percent penalty on being established that the undeclared wealth is unaccounted or black money, taking the total incidence of levies to 85 percent.

CBDT said: “Tax rate under section 115BBE is proposed to be increased only for unexplained income as there were reports that the tax evaders are trying to include their undisclosed income in the return of income as business income or income from other sources.

“The provisions of section 115BBE apply mainly in those cases where assets or cash etc. are sought to be declared as ‘unexplained cash or asset’ or where it is hidden as unsubstantiated business income, and the Assessing Officer detects it as such.”

The Bill also proposes to raise penalty under I-T Act for search and seizure cases by 3-fold to 30 per cent, a move aimed at deterring black money holders, from 10 or 20 percent currently.

Once the amendments are approved by Parliament, there would be a penalty of 30 percent of unaccounted income, if admitted and taxes are paid. This would take the total incidence of tax and penalty to 60 percent.

While proposing to amend Section 271AAB, the government has decided to retain the provision of levying penalty of 60 percent of income in “any other cases”. That would raise the incidence of tax and penalty to 90 percent.

During 2015-16, the I-T Department conducted 445 searches which discovered undisclosed income of Rs 11,066 crore. Total assets seized were Rs 712.68 crore.

Also 545 searches conducted in 2014-15 have led to admission of undisclosed income worth Rs 10,288 crore. Total assets seized amounted to Rs 761.70 crore.

Besides, 569 searches in 2013-14 saw admission of undisclosed income of Rs 10,791.63 crore and asset seizure of Rs 807.84 crore.

This took the total undisclosed income which was admitted during searches to Rs 32,146 crore.

Search and seizure operations are conducted by the tax department when the Assessing Officer believes that the assessee is unlikely to produce books of accounts or likely to suppress books of account and other documents which may be useful and relevant to an income tax proceedings.

Tax authorities will not seize jewellery/ornaments up to 500 grams for a “married lady,” 250 grams for an “unmarried lady” and 100 grams for a male individual:

Clarifying on the amendments in the Income Tax Act moved through the Taxation Laws (Second Amendment) Bill, 2016, the Ministry of Finance on Thursday said that that no “new provision” has been introduced to tax jewellery purchased from legal income even as it reiterated a 1994-dated CBDT instruction on gold limits that would apply in the event of the tax department’s search and seizure operation.

Tax authorities will not seize jewellery/ornaments up to 500 grams for a “married lady,” 250 grams for an “unmarried lady” and 100 grams for a male individual, even if “prima facie”, it does not seem to match with the income record of the assessee, the ministry said in its statement, referring to a CBDT circular dated May 11, 1994.

The tax officer conducting the search has the discretion to not seize even higher quantity of gold jewellery based on factors, including “family customs and traditions”, the ministry said in a series of clarifications.

The finance ministry issued four clarifications on this issue, wherein it was stated that there is no limit on holding of jewellery and ornaments if it is acquired from “explained sources” of income, including inheritance. It further said that the Taxation Laws (Second Amendment) Bill, 2016, which was passed by Lok Sabha on Tuesday, only seeks to enhance the applicable tax rate under section 115BBE of the Income-Tax Act, 1961, from existing 30 per cent to 60 per cent plus surcharge of 25 per cent and cess thereon.

“This Section (Section 115BBE) only provides rate of tax to be charged in case of unexplained investment in assets. The chargeability of these assets as income is governed by the provisions of Section 69, 69A & 69B, which are part of the Act since 1960s. The Bill does not seek to amend the provisions of these sections. Tax rate under Section 115BBE is proposed to be increased only for unexplained income as there were reports that the tax evaders are trying to include their undisclosed income in the return of income as business income or income from other sources,” the clarification said.

“The provisions of Section 115BBE apply mainly in those cases where assets or cash etc. are sought to be declared as ‘unexplained cash or asset’ or where it is hidden as unsubstantiated business income, and the assessing officer detects it as such,” it added.

It also said that the jewellery/gold purchased out of disclosed income or out of exempted income like agricultural income or out of reasonable household savings or legal inheritance or which has been acquired out of explained sources of income is “neither chargeable to tax” under the existing provisions “nor under the proposed amended provisions”.

“There is no new regulation with respect to search and seizure for jewellery. These limits flow from a CBDT instruction dated 1994. In any case, individuals owning jewellery and other assets which have been purchased out of disclosed income or through legitimate means (ancestral jewellery) have nothing to worry. In terms of disclosure requirements, individuals with taxable income exceeding Rs 50 lakh should have disclosed the details of jewellery held as on 31 March 2016 as part of the assets and liabilities schedule of the tax return. Prior to that till FY 2014-15, jewellery was considered as taxable wealth. Where an individual has complied with these requirements no challenges are envisaged,” Tapati Ghose, tax partner, Deloitte Haskins & Sells LLP said.

The government had moved amendments to the I-T Act in order to be able to impose a higher penalty and tax rate on assessees of unexplained deposits after concerns were raised that some of the existing provisions of the Act can possibly be used for concealing black money.

The 2016 Bill also proposed to introduce a scheme named Pradhan Mantri Garib Kalyan Yojana, 2016 (PMGKY), according to which a 30 per cent tax plus 33 per cent surcharge on the tax and a 10 per cent penalty is proposed to be levied on the undisclosed income in the form of cash and deposits. The individuals who hold jewellery bought from undisclosed income will not be eligible to avail the opportunity to disclose under the PMGKY scheme.

Along with the total 49.9 per cent of tax, penalty and surcharge, the declarant will have to deposit 25 per cent of the undisclosed income in a interest-free deposit scheme for four years. Among the other proposed amendments in the Bill, if the assessing officer determines the income as per Section 115BBE, then a penalty of 10 per cent would be levied along with the 75 per cent tax and surcharge. The current provision under Section 115BBE allows a flat rate of tax of 30 per cent plus surcharge and cesss.

The penalty in cases of search and seizure is proposed to be increased to 30 per cent of income if it is admitted, returns filed and taxes are paid. In all other cases, 60 per cent will be the penalty. Currently, the penalty is 10 per cent of the income, if the income is admitted, returned and taxes are paid and 20 per cent, if income is not admitted but returned and taxes are paid. Penalty is at 60 per cent in all other cases.